What do we show during virtual showings with investors?

Take a sneak peek into a virtual showing and how we break down the good the bad and the ugly. Being virtual gives us so many advantages but we have to show what is not so easily visible through a screen.

Waiting on the Housing Market to Crash?…

Don’t, Experts Say. Here’s How Today’s Market Is Different From the Great Recession Housing Bubble - By John Reed, Editor at NextAdvisor TIME

Home prices are higher than they’ve ever been, and they show no signs of stopping.

The median U.S. home listing price was $405,000 in March 2022, the first time it’s broken the $400,000 price threshold, according to data from Realtor.com. That is an increase of 26.5% over two years.

Homebuyers might see similarities between what’s happening today and the 2006 housing market where home prices became increasingly unaffordable until the bubble burst, helping trigger the worldwide financial crisis we came to call the Great Recession…READ MORE

Nine steps to building and maintaining credit

Thanks to our awesome friend Tammie Crainich at LoanDepot we were able to get this update on the market!

One of the most important things you can do to qualify for major purchases such as a car or home is to establish a good credit history. Whether you’re just starting out, or would like to improve your credit score, there are many ways to build and boost your credit.

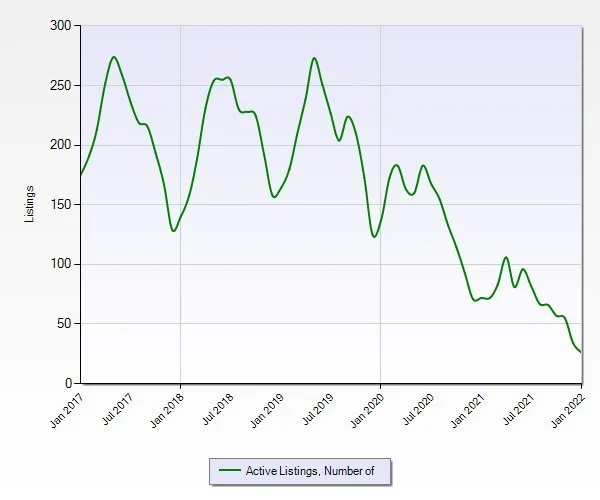

In Focus: Wilton Market

Doing a little market research on a potential new listing coming up.

The average Sales price in Wilton CT UP 20% since 2019

Number of active listings in December DOWN 72% since 2019

If you own in Wilton CT, let's chat.

Did you know about the GNND Program?

HUGE success story coming from one of our clients this month. About 3 years ago we helped our client purchase a property through the Good Neighbor Next Door program offered by HUD. This program offers select HUD homes to Teachers, Firefighters , EMT’s and Police officers for half off the listed price. It seems too good to be true right? Thats one of the first questions we hear from our prospective buyers that are hoping to take advantage of this program. As they say “nothing In life is free” well in this case it holds true. Although there are a few requirements and some hoops to jump through along the way, it's still one of the best programs we've seen be very beneficial.

Their main requirements are that buyers have to not have owned property for a year prior, service the community the property is located in, and of course be financially qualified. The other caveat to the program is the occupancy requirement. To fully satisfy the 50% “silent mortgage” buyers must live at the property for three years. Each month beginning at the closing the 50% discount is forgiven 1/36th until fully forgiven.

Enough about the program! Let’s hear about the success story! Not so fast. Did I mention you only have to put $100 down and can finance closing costs into the mortgage?

Our client bought 40 School St, East Hartford in 2019 for $67,500 with the GNND discount. I should note every HUD home is a foreclosure so they always come with some surprises, however this property had recently been renovated in the last 5 years and needed minor work. Their family was able to enjoy the property and spacious back yard while gaining more equity each month than they were paying in their mortgage. Even without the covid market we’ve had they would have been able to sell the property and earned a nice profit. With the market the way it has been we were able to market the property to receive multiple offers and able to close at our asking price of $250,000. With a profit of over $150,000 in three years (keep in mind this is tax free income) our buyers were able to use those proceeds to take the next step towards financial freedom.

To average that out they made an extra $50,000 a year tax free for utilizing the Good Neighbor Next Door program. When we enter our clients into the GNND lottery, it may seem like just a chance to buy a house, however it also could be an opportunity to gain $50,000 in net worth every year for 3 years.

If you know someone who's shoe this fits, send them our way! We'd love to continue to share this success. Click below to find out more!

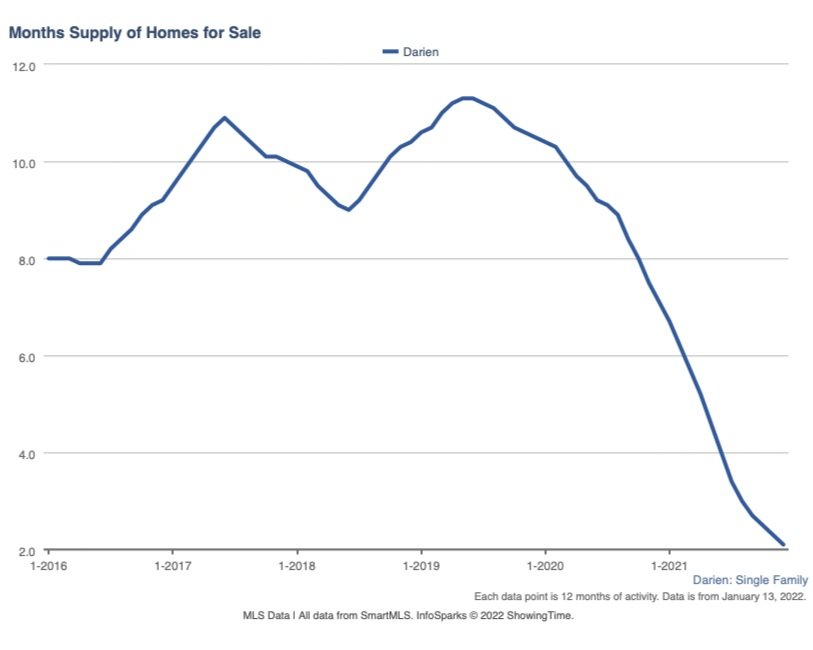

In Focus: Darien Market

Darien is a great example of what is going on with the current market and can give us insight into other desirable luxury towns in the area and the market as a whole.

Prior to Covid shifting buyers’ wants and needs, Darien was on the downline for the past five years with a drop in median sales price from $1,526,000 to $1,275,000. Since the bottom of the market in 2019, the median sales price has increased to $1,642,000. During this time we have seen unprecedented amounts of cash offers from buyers from NYC moving out to during the beginning of Covid and realizing they enjoy the life Fairfield County has to offer.

The currently only 16 Active single-family listings in Darien. Of those 16, only 8 have been on the market for less than 30 days. We saw a major inventory issue last spring as buyers bought up anything available and compromised on the property suiting their needs. We fully expect this to continue as we have around a third of the listings year over year and only 17% of the typical listings prior to covid.

You may think this all means that transactions aren’t happening and the total volume of transactions is down. That couldn’t be further from the truth. While we are having an issue with listings being active on the market, we are also experiencing a surge in homes trading hands.

Our advice on winning multiple offers and getting into the town, school system, area, property you want:

Be aggressive with your offer price

Make quick decisions

Find out the motivations of the sellers.

Make the terms as agreeable as possible

Get creative in ways other offers aren't

Hire us to get the job done!

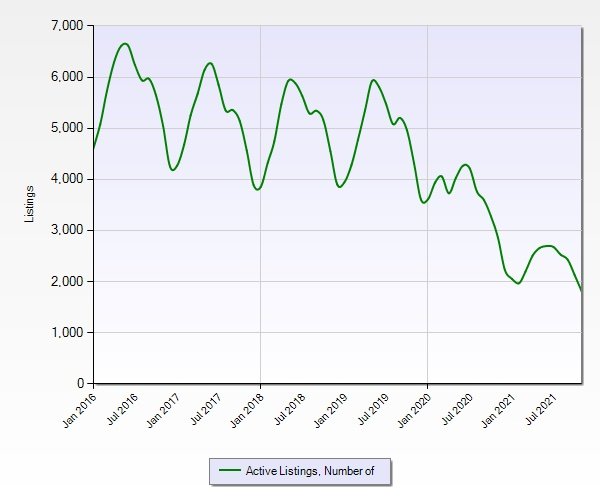

Spring Market Outlook

We’ve been reading the tea leaves for the last few weeks trying to answer “how is the spring market going to look”. We have some troubling news. We could be in for another wild sellers market. The single family market in Fairfield County has been seeing a reduction of new listings of over 10%, some months as much as 30%. November ended with 1,808 single family listings pre covid bounced around 5,000.

When chatting with one of our lender partners, Tammie Crainich of Loan Depot, she felt confident to advise us that interest rates are expected to stay below 4% for the spring market. Interest rates are one of the only foreseeable reasons home prices might decline.

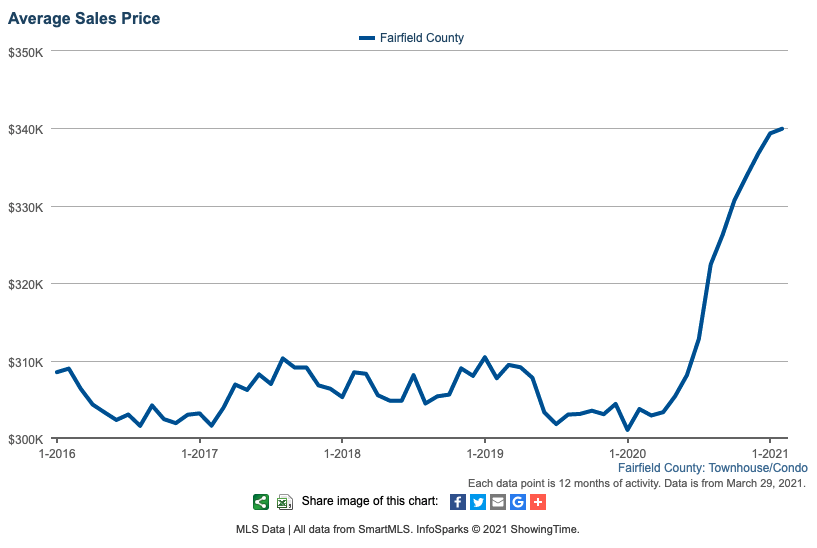

As Single Family, Multi Family and even rentals have low inventory, rising prices we expect Condo’s to become more popular as buyers are priced out of their ideal home. Condos haven’t appreciated as quickly as the other class’ of residential real estate.

TL:DR Spring market is going to be great for sellers, brutal for buyers. Rates to remain low. Condos are going to become more popular.

Week of October 25, 2021 in Review

Thanks to our awesome friend Tammie Crainich at LoanDepot we were able to get this update on the market!

News regarding new home sales, home appreciation and inflation all made headlines. But what does the data really mean?

Sales of new homes surged in September, rising 14% from August at an 800,000 annualized pace. This was stronger than expectations and the highest reading since March. However, on an annual basis, sales were 18% lower when compared to September of last year – but there is more to this story as noted below. Meanwhile, Pending Home Sales, which measure signed contracts on existing homes, fell 2.3% in September after an 8% gain in August.

The ongoing high level of demand for homes around the country continues to help prices appreciate. The Case-Shiller Home Price Index showed that home prices rose 1.2% in August and 20% year over year. The Federal Housing Finance Agency (FHFA), which measures home price appreciation on single-family homes with conforming loan amounts, also reported that home prices rose 1% in August and 18.5% when compared to August of last year. While these are certainly still strong levels of appreciation, there are signs that appreciation may be moderating. Don’t miss the explanation below.

The latest Personal Consumption Expenditures (PCE) report showed that consumer inflation was up 0.3% in September. Year over year the index rose from 4.2% to 4.4%, which is the hottest reading in 30 years. Core PCE, which strips out volatile food and energy prices and is the Fed’s real focus, was up 0.2% in September while the year over year reading remained at 3.6%.

Rising inflation is always critical to monitor because it can have a big impact on Mortgage Bonds and home loan rates, which are tied to them. While the annual Core PCE figures may appear to suggest that consumer inflation is holding steady, it’s important to look further into the data. Read on for additional analysis about this.

The unemployment picture continues to improve, as the number of people filing for benefits for the first time and on a continuing basis both declined to their lowest levels since before the pandemic began. Extended Benefits and the federal COVID plans all showed declines in the latest week as well. There are now 2.8 million people in total receiving benefits, which is down by almost 450,000 from the previous week.

Lastly, the first look at Gross Domestic Product (GDP) for the third quarter showed annualized growth of 2%, which was below the estimate of 2.6% but better than the 0.5% estimate from the Atlanta Fed. Real final sales fell 0.1%, which means that most of the gain came from inventory build and this added 2% to GDP. Personal spending was up 1.6%, driven by spending on services, as goods spending fell. Remember that GDP was 6.7% annualized in the second quarter so this third quarter reading reflects a big revision lower on full year GDP.

Home Price Appreciation Hits Another Record High

Thanks to our awesome friend Tammie Crainich at LoanDepot we were able to get this update on the market!

The Case-Shiller Home Price Index, which is considered the “gold standard” for appreciation, showed home prices rose 1.6% in July and 20% year over year. This annual reading set another record high, beating June’s 18.6% record.

The 20-city index also rose 20% year over year, with all the cities showing strong gains. Phoenix (+32%), San Diego (+28%), and Seattle (+26%) continued to report the highest annual gains.

The Federal Housing Finance Agency (FHFA) also released their House Price Index, which measures home price appreciation on single-family homes with conforming loan amounts. While you can have a million-dollar home with a conforming loan amount, the report most likely represents lower-priced homes, where supply has been tight and demand strong.

Home prices rose 1.4% in July and they were also up 19% year over year. This is the first time in recent memory that we have seen FHFA’s data below Case Shiller’s.

This dynamic shift could mark the peak of year-over-year appreciation gains. While monthly appreciation gains are still expected to occur, they could start to slow and this would make the year-over-year figures start to come down a bit. It’s important to note this does not mean home prices are expected to decline because there is still too big of a crop of homebuyers for too few homes. But the pace of gains could slow.

Rents are also rising at a feverish pace. Apartment List reported that rents rose 2.1% in September and 16.4% year to date, up from 13.8% in the previous report. This is the fastest rent growth on record and is on a 22% pace if these increases continue. To put this into context, rents from January 2017 to September 2019 averaged just a 3.4% rise. In addition, only a few cities remain cheaper than they were pre-pandemic, while 22 cities have increased more than 25% from the start of the pandemic.

What the Median Price of Existing Home Sales Means

Thanks to our awesome friend Tammie Crainich at LoanDepot we were able to get this update on the market!

Existing Home Sales, which measure closings on existing homes, rose 1.4% from May to June. On an annual basis, they were up 23% compared to June of 2020, which makes sense given the pandemic-related shutdowns last year.

Inventory still remains a huge challenge for buyers, though we did see an improvement. There were 1.25 million homes for sale, which is up 3.3% from May and this also follows a 7% increase in the previous report. While inventory is still down 19% year over year, it is getting a bit better.

The median home price was reported at a record high $363,300, which is up 23.4% year over year. Though the media might report this otherwise, it’s really important to understand that the median home price is not the same as appreciation. It simply means half the homes sold were above that price and half were below it, and the rise is due to the amount of higher-end homes that are selling. Sales of homes beneath $250,000 were down 15%,while sales of homes over $1 million were up 150%. Real appreciation is around 14%, and while this is still a high number, it is significantly less than the 23.4% rise in the median home price.

First-time homebuyers have accounted for at least 31% of sales over the last 5 months. While affordability is certainly a bit tougher with higher home prices, rates are still very attractive and first-time home buyers are clearly hanging in there.

Meanwhile, cash buyers remained stable at 23%, though this number is up 16% from last year. Investors purchased 14% of homes, down from 17% from May.

To buy a condo or to buy a single family, that is the question…

Why haven't we seen any appreciation in condo values?

Currently, we’ve been fairly flat year over year, and a slight increase over the last 5. Some of the reasons could be the huge influx of NY buyers looking for more space, specifically green spaces, and primarily looking to buy Single Family properties.

Since January last year we have seen almost a 30% increase in the average sale prices of single family properties. This doesn’t mean each properties value has gone up 30%, however we are seeing the higher end of the market move along with almost no “affordable” inventory under $500,000 in the greater Stamford area.

We don’t expect this market to change too much for the next year unless something major happens. We have a lot of built up demand and for the most part the potential buyers in Fairfield County have remained fully employed.

In the end, we expect the single family properties to remain too expensive for the average buyer AND we think the trend will go back to normal where we have buyers coming back to the worry free lifestyle of a luxury condo as long as HOA fees don't get in the way.

HAPPY HUNTING TO ALL!

Spring Real Estate Inventory Brings Hope to the Market

What a few wild weeks of real estate in Southern CT!

Remember at the beginning of the pandemic when you couldn’t find any lysol, paper towel or toilet paper? Well that’s how residential real estate is feeling like. We have LESS THAN 50% of our normal inventory on the market right now.

A trend that has always been a part of CT real estate that is becoming increasingly more popular is NYC/Brooklyn residents looking for an escape for the summer in CT. Properties with pools near oceans or lakes have seen their values skyrocket.

Keep in mind, January and February are known for lower inventory levels. As the spring market ramps up we do expect more inventory to come on the market and attempt to catch up with the buyer demand.

Advise?

To Our Buyers:

Keep faith, we will search for off market properties and help track down the perfect property for you

To Our Sellers:

LIST NOW